The location on the PPF depends on prices. The firms in this economy take prices as given. The fractions in the example I was able to create get fairly messy.

4.1 Autarky Equilibrium

First, consider the interest rate and the prices shown in Table 4-1. Table 4-2 shows the cost of producing one unit (barrel ale or bushel corn) for each known process. I assume that wages and rents are paid at the end the production period, while capital goods are purchased at the start. Hence, Table 4-2 shows interest charges on the capital goods used as inputs into production, but not on labor and land services.

| Wage: | 5,039/37,650 ~ 0.134 Bushels per Person-Year |

| Rent: | 1/10 Bushels per Acre |

| Ale: | 563/1,506 ~ 0.374 Bushels Per Barrel |

| Interest Rate: | 1/50 = 2% |

| Industry | Process | Cost | Revenue |

|---|---|---|---|

| Ale | (1/8)(1 + 1/50) + (1)(5,039/37,650) + (9/8)(1/10) = 563/1,506 | 563/1,506 | |

| Corn | A | (1)(563/1,506)(1 + 1/50) + 4(5,039/37,650) + (5/6)(1/10) = 1 | 1 |

| Corn | B | (1/2)(563/1,506)(1 + 1/50) + 7(5,039/37,650) + (1)(1/10) = 36,973/30,120 | 1 |

Notice that in Table 4-2, revenue received from producing ale exactly covers the cost. Likewise, the revenue received from producing corn with the first corn-producing process exactly covers cost. There are no pure economic profits. And the cost from producing corn with the second corn-producing process exceeds the revenues. So a cost-minimizing firm would not use the second corn-producing process. These are equilibrium prices in which corn and ale are produced with the Alpha technique. That is, with these prices, profit-maximizing firms would choose to produce such that the economy was at point a = (20 barrels ale, 50 bushels corn) on the PPF shown in Figure 3-2. This is the level of consumption with these prices.

4.2 International Trade

Now introduce the possibility of trading consumption goods on the international market. I postulate a price of ale on this market of 99/200 bushels per barrel. (In a model of a small economy, such as this example, the effects on international prices of variations of output of a small economy are assumed to be negligible.) Assume that factors of production (land, labor, and ale and corn used as capital goods) still cannot be traded internationally. This is the standard introductory assumption of the textbook and Hekscher-Ohlin-Samuelson theory. Since this example constitutes an internal critique of the HOS model, I make the model assumptions.

Table 4-3 shows the accounting for costs and revenues in this case. International trade is like a technological innovation; it introduces more processes into the table. A firm can now produce a barrel ale for consumption by first producing 99/200 bushels of corn for consumption with the cheapest corn-producing process, then trading it for a barrel ale on the international market. This possibility is shown in the second ale-producing process in the table, labeled “Trade”. Likewise, the possibility of international trade introduces a third corn-producing process. Here, 2 2/99 barrels of ale for consumption are produced and traded on the international market.

| Industry | Process | Cost | Revenue |

|---|---|---|---|

| Ale | (1/8)(1 + 1/50) + (1)(5,039/37,650) + (9/8)(1/10) = 563/1,506 | 563/1,506 | |

| Ale | Trade | [(1)(563/1,506)(1 + 1/50) + (4)(5,039/37,650) + (5/6)(1/10)](99/200) = 99/200 | 563/1,506 |

| Corn | A | (1)(563/1,506)(1 + 1/50) + 4(5,039/37,650) + (5/6)(1/10) = 1 | 1 |

| Corn | B | (1/2)(563/1,506)(1 + 1/50) + 7(5,039/37,650) + (1)(1/10) = 36,973/30,120 | 1 |

| Corn | Trade | [(1/8)(1 + 1/50) + (1)(5,039/37,650) + (9/8)(1/10)](200/99) = 56,300/74,547 | 1 |

What would a profit-maximizing firm produce under these conditions? Notice that the cost of producing ale by first producing corn and trading it exceeds the revenue from selling ale domestically. Clearly, no firm will sell corn on the international market. But there are pure economic profits to be obtained by producing ale and trading it for corn on the international market. So all firms will rush into ale production. Since corn is then nowise produced for use as a capital good under these circumstances, these cannot be equilibrium prices.

But the managers of firms find they have a comparative advantage in producing ale.

4.3 Equilibrium with International Trade

As with invalid introductory mainstream textbooks, I ignore disequilibrium transition paths. Consider the prices in Table 4-4, in which the interest rate remains unchanged. The domestic price of ale is now equal to the (given) international price of ale. The cost accounting shown in Table 4-5 results.

| Wage: | 75,759/1,100,000 ~ 0.0689 Bushels per Person-Year |

| Rent: | 36,499/137,500 ~ 0.265 Bushels per Acre |

| Ale: | 99/200 Bushels Per Barrel |

| Interest Rate: | 1/50 = 2% |

| Industry | Process | Cost | Revenue |

|---|---|---|---|

| Ale | (1/8)(1 + 1/50) + (1)(75,759/1,100,000) + (9/8)(36,499/137,500) = 99/200 | 99/200 | |

| Ale | Trade | [(1/2)(99/200)(1 + 1/50) + (7)(75,759/1,100,000) + (1)(36,499/137,500)](99/200) = 99/200 | 99/200 |

| Corn | A | (1)(99/200)(1 + 1/50) + 4(75,759/1,100,000) + (5/6)(36,499/137,500) = 150,239/150,000 | 1 |

| Corn | B | (1/2)(99/200)(1 + 1/50) + 7(75,759/1,100,000) + (1)(36,499/137,500) = 1 | 1 |

| Corn | Trade | [(1/8)(1 + 1/50) + (1)(75,759/1,100,000) + (9/8)(36,499/137,500)[(200/99) = 1 | 1 |

No pure economic prices can be earned by operating any process under these prices. Ale and corn for use as capital goods are produced by the domestic ale-producing process and the second corn-producing process. The domestic production of this economy is at point b on the PPF graphed in Figure 3-2. And prices are such that firms would be willing to trade either consumable ale or corn internationally. The revenues just cover costs in both processes labeled “Trade” in Table 4-5.

4.4 Comparison

In the autarkic equilibrium analyzed in Section 4.2, a consumption bundle of 20 barrels ale and 50 bushels corn is available to the consumers in the economy. After trade is introduced, the firms produce a consumption bundle of 80 barrels ale and 20 bushels corn. Since the price of ale on the international market is 99/200 bushels per barrel, 60 of the 80 barrels available for consumption might be traded internationally to obtain 60 * 99/200 = 29 7/10 bushels corn. That is, after international trade, the consumers in this economy have available a consumption bundle of 20 barrels ale and 49 7/10 bushels of corn. The introduction of trade has resulted in a loss of 3/10 bushels corn in consumption. This contrasts with misleading mainstream economics textbooks in which trade due to comparative advantage moves the PPF unambiguously outward.

The equilibrium prices with trade are different than the initial prices for an equilibrium in autarky. The individuals in this economy might react to this difference in prices by consuming a different proportion of commodities. I leave it to the interested reader, if any, to demonstrate that utility functions can constructed for some economies in which the gain from utils from this exchange effect does not overcome the loss from specialization. Metcalfe and Steedman suggest postulating:

”a homothetic utility function that is the same for all income recipients who, in addition, express their preference between present and future consumption through a universal and positive rate of time preference.”

Appendix 4.A Switch Point Prices

Consider the line segment between points a and b on the Production Possibilities Frontier in Figure 3-2. Along this line segment all three production processes shown in Table 2-1 are cost-minimizing. In other words, this line segment corresponds to switch points on the so-called factor-price frontier. This appendix considers what the price of ale must be at a switch point. For all three processes to be cost-minimizing, the following system of equations must be satisfied:

(1/8)(1 + r) + w + (9/8) W = p

p(1 + r) + 4 w + (5/6) W = 1

(1/2)p(1 + r) + 7 w + W = 1

where:

- p is the price of ale (in bushels per barrel)

- w is the wage (in bushels per person-year)

- W is the rent (in bushels per acre)

- r is the interest.

Each production process provides an equation in the above system. Note that if the interest rate is specified, this is a system of three linear equations in three unknowns (p, w, and W. The system has a unique solution in terms of the interest rate:

p = (1/2) (15 + r)/(15 + 11r)

w = (1/44)(7r + 5)(r + 9)/(15 + 11r)

W = (3/11)(15 - 14r - 5rr)/(15 + 11r)

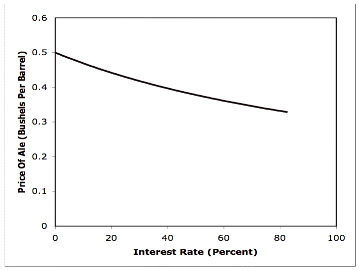

Figure 4-1 graphs the price of ale, as a function of the interest rate, at switch points where both techniques are cost-minimizing. The graph ends at an interest rate of r = (-7/5) + 2 sqrt(31)/5, which is approximately 82.7%. Above this rate, the rent is negative, an economically meaningless case.

|

|---|

| Figure 4-1: Price Of Ale At Switch Points |

Notice that at an interest rate of zero, the switching price is one-half bushels per barrel. And this price is numerically identical to the slope, between points a and b, of the Production Possibilities Frontier shown in Figure 3-2. On the other hand, at positive interest rates, this switching price falls below one-half bushels per barrel. It is this deviation of this switching price from the slope of the Production Possibilities Frontier that creates the possibility that when the firms in a country specialize as according to the theory of comparative advantage, the country becomes worse off.

"Assume that factors of production (land, labor, and ale and corn used as capital goods) still cannot be traded internationally. This is the standard introductory assumption of the textbook and Hekscher-Ohlin-Samuelson theory. Since this example constitutes an internal critique of the HOS model, I make the model assumptions."

ReplyDeleteIs the H.O. assumption that capital goods can't be traded, or is the assumption that financing for capital goods must come from domestic sources, which would imply that goods used as capital could still be purchased at world prices? Admittedly the treatment of capital is vague, but the discussion of capital markets in the international finance literature suggests to me that the intent at least is to rule out access to international financial markets and consider only the effects of trade in goods.

Thanks for the comment.

ReplyDeleteI take one assumption of the HOS theory to be that factors of production are immobile among countries. And I would think that teaching in mainstream economics, if it was any good, would be clear about the distinction between capital as goods and capital as finance. I don't know why good teaching nowadays cannot be clear, instead of vague.

I consider HOS theory to be valid only when capital goods are not a factor of production. The factors are land and labor. Both can be heterogeneous.

Mayhaps you will find my concluding post helpful.

I was thinking more along the lines of Acheson's 1970 JPE piece, which uses a value interpretation of the endowment. Steedman's work on the subject is also interesting. I think the literature on capital theory is worth reading. My concern is that by using examples that make additional assumptions that an economist might feel are at odds with the "spirit" of standard models, you provide a ready rationale for not being taken seriously.

ReplyDeleteConfusion over the meaning of capital seems, based on my experiences, widespread throughout the discipline. I suspect it is a combination of the discipline's reliance on the "heuristic" one good models in macro, the desire for a reasonably simple model, and the general socialization of the discipline.

Thanks. I can't promise to look up Acheson (1970) quickly.

ReplyDeleteNo worries. Acheson provided one of the early attempts to extend the debates on capital theory to the trade literature. After reading Mandler's "Dilemmas", I'm not sure that Acheson's model is particular satisfying (it depends on how you interpret substitutability in the model). What is curious is how papers like it have disappeared from the radar entirely. Feenstra provides an example of capital "reversals" in his recent graduate textbook that I think reveals the usual sloppiness on the part of economists as they talk about "capital".

ReplyDelete