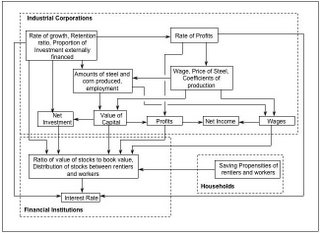

The previous three parts specify a steady-state growth model applicable to an advanced capitalist economy. Figure 2 summarizes the structure of this model. The arrows indicate how variables are determined, including accounting identities, in the mathematical structure of the model. Notice that the major macroeconomic variables are determined by decisions within the corporations. Household savings decisions can affect only the overall value of stocks and the personal distribution of income. Control over the means of production determines the functional distribution of income.

|

| Figure 2: Dependencies Among Variables and Parameters |

| Variant | Characterization | Parameters |

|---|---|---|

| Kaldor (1966) variant | No class of pure capitalists | sr = 0, j = 1 |

| Pasinetti (1962) variant | No corporate sector | sc = 0, f = 1, v = 1 |

REFERENCES

- Kahn, R. F. (1959). "Exercises in the Analysis of Growth", Oxford Economic Papers, New Series, V. 11: 143-156

- Kaldor, Nicholas (1956). "Alternative Theories of Distribution", Review of Economic Studies, V. XXIII: 83-100

- Kaldor, Nicholas (1966). "Marginal Productivity and the Macroeconomic Theories of Distribution: Comment on Samuelson and Modigliani", Review of Economic Studies, V. XXXIII, N. 4 (Oct.): 309-319

- Kregel, J. A. (1985). "Hamlet without the Prince: Cambridge Macroeconomics without Money", American Economic Review, V. 75, N. 2 (May): 133-139

- Moss, S. J. (1978). "The Post-Keynesian Theory of Income Distribution in the Corporate Economy", Australian Economic Papers, V. 17, N. 31 (Dec.):303-322

- Park, Man-Seop (2006). "The Financial System and the Pasinetti Theorem", Cambridge Journal of Economics, V. 30: 201-217

- Pasinetti, Luigi L. (1962). "Rate of Profit and Income Distribution in Relation to the Rate of Economic Growth", Review of Economic Studies, V. XXIX, N. 4 (Oct.): 267-279

- Robinson, Joan (1962). Essays in the Theory of Economic Growth, Macmillan

No comments:

New comments are not allowed.