"Then Buddha said: ... But tell me, Subhuti, do you really believe that having only one homogeneous capital good will permit you to derive a rate of profit purely from the technical relationship between homogeneous capital and output?

Subhuti replied: Thus it is said in some venerable books.

Buddha said: Revere them, Subhuti, but trust them not. Suppose you do get the value of the marginal product of capital in terms of output of consumer goods. In what units will it be expressed? Physical units of additional consumer goods per unit of additional homogeneous capital. But the rate of profit is a pure number. Surely you will need something more in going from the first to the second to reflect the relative price of the capital good vis-a-vis the consumer good. But the equilibrium price of capital in units of consumer goods depends on the rate of profit used for discounting, and a variation of the rate of profit can involve a variation of the value of the same physical capital in units of consumer goods. This difficulty is not eliminated by having one homogeneous good." -- Amartya Sen (1974). "On Some Debates in Capital Theory", Economica V. 41 (August)

1.0 Introduction

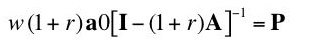

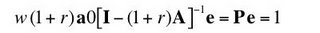

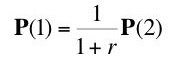

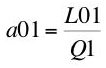

This essay demonstrates that the existence of price Wicksell effects can lead to the inequality of the marginal product of capital and the interest rate. The equality being challenged here should be understood as it is used in macroeconomic models with aggregate production functions. That is, macroeconomic modeling with aggregate production functions is inadequately grounded in microeconomic theory. I conclude with some rather far-reaching possibilities.

The length of my exposition here results from my attempting to clarify several points of confusion exhibited by economists responding on Usenet to previous versions. This argument is well-established in the literature [1]. I suggest that those who think this argument mistaken should take a look at some of my references. If my argument were mistaken, demonstrating the mistake would be worthy of a paper.

I claim this argument is not about index number problems or the aggregation of capital [2]. I also do not see how it relates to the aggregation of production functions. Those who believe otherwise are encouraged to be explicit about the connections. Perhaps, the question, from a neoclassical perspective, is how the services of capital goods are related to the quantity of "waiting" they supposedly represent.

Footnotes

[1] Elements of this argument can be found in Joan Robinson's 1953-1954 article "The Production Function and the Theory of Capital," Review of Economic Studies, 1953-4 and Geoff Harcourt (1972), Some Cambridge Controversies in the Theory of Capital. The closest formulation to my argument is in the following papers:

- Amit Bhaduri (1966). "The Concept of the Marginal Productivity of Capital and the Wicksell Effect," Oxford Economic Papers, XVIII: 284-288

- Amit Bhaduri (1969). "On the Significance of Recent Controversies on Capital Theory: A Marxian View," Economic Journal, LXXIX: 532-539

- Piero Sraffa (1962). "Production of Commodities: A Comment," Economic Journal, V. LXXII (June): 477-9.

"Now a major problem existed because capital, unlike either labor or land, is a produced means of production and cannot be measured unambiguously in purely physical terms: the amount of capital can be measured only in value terms. The problem was to establish the idea of a market for capital, the quantity of which could be expressed independently of the price of its service (i.e. the rate of profit)... The basic deficiency with this approach is in its treatment of capital, which cannot be measured independently of the rate of profit. As observed above, the value of capital, like that of all produced commodities, depends on the rate of profit, or interest." -- J. E. Woods (1990). The Production of Commodities: An Introduction to Sraffa, Humanities Press International: 306-307

[2] The divergence between the marginal product of capital and the rate of interest

"is attributable to the fact that it is impossible to find an invariant unit in which to measure the social quantity of capital.Metzler provides a brief literature review of awareness of this problem going back to Wicksell. My analysis is closest to his comments on Knight's capital theory, though I think my presentation is clearer.

To put the matter another way, we may say that a change in the supply of capital - arising, for example, from new voluntary savings - alters the units in which all the previously existing capital is measured; and it is therefore incorrect to say that the supply of capital as a whole has increased by the amount of the voluntary saving. It is important to emphasize that this problem of measuring the quantity of capital is not an index-number problem. There are, to be sure, numerous index-number problems of the greatest complexity in the theory of capital. But the problem to which I now refer would exist even in the simplest economy in which all output consisted of a single type of consumer's good and firms were exactly alike." -- L. A. Metzler (1950). "The Rate of Interest and the Marginal Product of Capital," Journal of Political Economy, Vol. 53: 284-306