Carlo Milana has posted a paper on arXiv. I was prepared to accept this paper's claims. Economists have developed

price theory. Referring to Sraffian "paradoxes" and "perverse" switch points is a matter of speaking.

There does not exist separate Sraffian and neoclassical versions of price theory. For a result to be "perverse",

it need only contradict outdated neoclassical intuition. But it is as much a part of the mathematical economics

as any other result. (It is another matter that much teaching in microeconomics is inconsistent with the mathematics.)

In equilibrium, the price of the services of each capital good in use is equal to the value of the marginal product

of that good, with all prices discounted to the same moment in time. This discounting implies that the interest

rate appears in a formal statement of these equations. These equalities are very different from the claim

that the interest rate equals the marginal product of (financial) capital.

In limited cases, one can prove something like

the aggregate equality.

No such thing as a marginal productivity theory of distribution, however,

is restored.

Milana might cite Hahn (1982) on this background.

But Milana goes further. He claims that reswitching is impossible or, at least, examples up

to now are erroneous.

I think Milana's basic mistake is exposed in

Salvadori and Steedman (1988).

(I go through one of their examples

here.)

The Samuelson-Garegnani model is not a model of two-(produced) goods.

The model contains as many capital goods as there are techniques. Potentially, there

can be a continuum of capital goods in the model. As such, it is meaningless to

require the price of the capital goods used in each technique that is cost-minimizing

at a switch point to be equal to one another. That is analogous to requiring

the price of a ton of iron be equal to the price of a ton of tin.

For some reason, Milana does not discuss examples of reswitching in flow-input, point output

models, such as in Samuelson (1966). Nor does he acknowledge, as I read him, valid examples in

which the same n commodities are produced in all techniques, and all commodities

are basic in all techniques. (Does he say anything at all about the distinction between

basic and non-basic commodities?) At a non-fluke or generic switch point, in such

a framework, the two techniques that are cost-minimizing differ in a process in exactly

one industry.

Milana should read and reference Bharadwaj (1970), as well as Bidard and Klimovsky (2004)

on fake switches in models of joint production. Other Linear Programming formulations

are available for considering the choice of technique. Vienneau (2005) presents one.

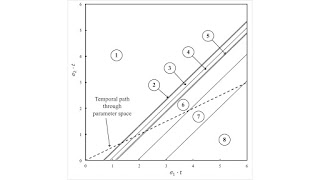

What does Milana have to say about the direct method for analyzing the choice of

technique in Kurz and Salvadori (1995)? I briefly provide a survey of different

analysis in Vienneau (2017), as well as an algorithm for finding the

cost-minimizing technique? Are all these approaches in error?

References

- Khrishna Bharadwaj. 1970. On the maximum number of switches between two production systems. Schweizerische Zeitschrift fur Volkswortschaft and Statistik (4): 401-428. Reprinted in Bharadwaj 1989. Themes in Value and Distribution: Classical Theory Reappraised, Unwin-Hyman.

- Christian Bidard and Edith Klimovsky. 2004. Switches and fake switches in methods of production. Cambridge Journal of Economics 28:89-97

- Frank Hahn. 1982. The neo-Ricardians Cambridge Journal of Economics 6:353-374.

- H. D. Kurz and N. Salvadori. 1995. Theory of Production: A Long-Period Analysis. Cambridge University Press.

- Carlo Milano. 2019. Solving the Reswitching Paradox in the Sraffian Theory of Capital. arXiv:1907.01189

- Neri Salvadori and Ian Steedman. 1988. No reswitching? No switching! Cambridge Journal of Economics 12: 481-486.

- Paul A. Samuelson. 1966. A Summing Up. The Quarterly Journal of Economics 80 (4): 568–583.

- Robert Vienneau. 2005. On labour demand and equilibria of the firm. The Manchester School 73(5): 612-619.

- Robert Vienneau. 2017. The choice of technique with multiple and complex interest rates. Review of Political Economy 29(3): 440-453.