|

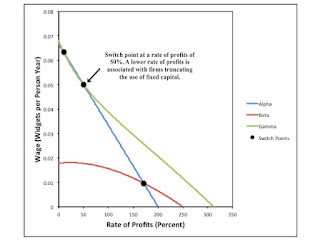

| Figure 1: Aggregate Production Function |

1.0 Introduction

This long post presents an analysis of the choice of technique in a three-commodity example. This example extends a previous post. Two processes are known for producing each commodity. The example is simple in that it is of a model only of circulating capital. No fixed capital - that is, machines that last more than one period - exists in the model. Homogeneous labor is the only non-produced input used in production.

Despite these simplifications, many readers may prefer that I revert to examples with fewer commodities and processes. Eight techniques arise for analysis. All three commodities are basic in all techniques. I end up with 34 switch points. Even so, various possibilities in the theory are not illustrated by the example. (Heinz Kurz and Neri Salvadori probably have better examples. I also like J. E. Woods for exploring possibilities in linear models of production.) The example does suggest, however, that the exposed errors taught, around the world, to students of microeconomics and macroeconomics cannot be justified by the use of continuously differentiable, microeconomic production functions.

2.0 Technology

This economy produces a single consumption good, called corn. Corn is also a capital good, that is, a produced commodity used in the production of other commodities. In fact, iron, steel, and corn are capital goods in this example. So three industries exist. One produces iron, another produces steel, and the last produces corn. Two processes exist in each industry for producing the output of that industry. Each process exhibits Constant Returns to Scale (CRS) and is characterized by coefficients of production. Coefficients of production (Table 1) specify the physical quantities of inputs required to produce a unit output in the specified industry. All processes require a year to complete, and the inputs of iron, steel, and corn are all consumed over the year in providing their services so as to yield output at the end of the year.

Table 1: The Technology

| Input | Iron

Industry | Steel

Industry | Corn

Industry |

| a | b | c | d | e | f |

| Labor | 1/3 | 1/10 | 1/2 | 7/20 | 1 | 3/2 |

| Iron | 1/6 | 2/5 | 1/200 | 1/100 | 1 | 0 |

| Steel | 1/200 | 1/400 | 1/4 | 3/10 | 0 | 1/4 |

| Corn | 1/300 | 1/300 | 1/300 | 0 | 0 | 0 |

A technique consists of a process in each industry. Table 2 specifies the eight techniques that can be formed from the processes specified by the technology. If you work through this example, you will find that to produce a net output of one bushel corn, inputs of iron, steel, and corn all need to be produced to reproduce the capital goods used up in producing that bushel.

Table 2: Techniques

| Technique | Processes |

| Alpha | a, c, e |

| Beta | a, c, f |

| Gamma | a, d, e |

| Delta | a, d, f |

| Epsilon | b, c, e |

| Zeta | b, c, f |

| Eta | b, d, e |

| Theta | b, d, f |

3.0 Choice of Technique

Managers of firms choose processes in their industry to minimize costs. So one must consider prices in analyzing the choice of technique. Assume that corn is the numeraire. In other words, the price of a bushel corn is one monetary unit. I assume that labor is advanced, and that wages are paid out of the surplus at the end of the year.

These conditions specify a system of three equations that must be satisfied if a technique is to be chosen. For example, suppose the Alpha technique is in use. Let wα be the wage and rα the rate of profits. Let p1 be the price of iron and p2 the price of steel. If managers are willing to continue producing iron, steel, and corn with the Alpha technique, the following three equations apply:

((1/6)p1 + (1/200)p2 + (1/300))(1 + rα) + (1/3)wα = p1

((1/200)p1 + (1/4)p2 + (1/300))(1 + rα) + (1/2)wα = p2

(p1)(1 + rα) + wα = 1

These equations apply to iron, steel, and corn production, respectively. They show the same rate of profits being earned in each industry. Confining one's attention to the three processes comprising the Alpha technique, they show the same rate of profits being earned in each industry. Managers will not want to disinvest in one industry and invest in another, at least, with these three processes available.

Suppose the wage is given, is non-negative, and does not exceed a certain maximum specified, for a technique, by a zero rate of profits. Then, for each technique, one can find the rate of profits and prices of commodities. The function relating the rate of profits to the wage for a technique is known as the wage-rate of profits curve, or, more shortly, the wage curve for the technique. Figure 2 graphs the wage-rate of profits curves for the eight techniques in the example.

|

| Figure 2: Wage-Rate of Profits Curves |

The cost minimizing technique, at a given wage, maximizes the rate of profits. That is, wage curves for cost minimizing techniques form the outer envelope of the wage curves graphed in Figure 2. Table 3 lists the cost minimizing techniques for the example, from a wage of zero to the maximum wage. The switch points on the frontier are pointed out in Figure 2. This is not an example of reswitching or of the recurrence of techniques. No technique is repeated in Table 3. It is an example of process recurrence. The corn-producing process labeled "e", repeats in Table 3. I label the switch point between Alpha and Beta as "perverse" just to emphasize that results arise for it that violate the beliefs of outdated and erroneous neoclassical economists. From the standpoint of current theory, it is not any more surprising than non-perverse switch points.

Table 3: Techniques on Frontier

| Technique | Processes |

| Alpha | a, c, e |

| Beta | a, c, f |

| Delta | a, d, f |

| Theta | b, d, f |

| Eta | b, d, e |

I experimented, somewhat, with the coefficients of production for alternative processes in the various industries, but not all that much. Thirty four switch points exist in the example, including switch points (some "perverse") inside the frontier. No techniques have three switch points, even though in a model with three basic commodities, such can happen. As noted above, no reswitching occurs on the frontier. But consider switch points for each pair of techniques, including within the frontier. Under this way of looking at the example, reswitching arises for the following pair of techniques:

- Alpha and Beta: Vary in corn-producing process.

- Alpha and Delta: Vary in steel-producing process.

- Alpha and Zeta: Vary in iron-producing and corn producing processes.

- Alpha and Theta: No processes in common.

- Gamma and Delta: Vary in corn-producing processes.

- Gamma and Zeta: No processes in common.

- Gamma and Theta: Vary in iron-producing and corn producing processes.

Generically, in models with all commodities basic, techniques that switch on the frontier differ in one process. So one could form a reswitching example with two technique out of the processes comprising, for example, the Alpha and Delta techniques.

Figure 2 is complicated, and some properties of the wage curves are hard to see, no matter how close you look.

All wage curves slope downward, as must be the case. The wage curve for, for example, the Alpha technique varies in convexity, depending at what wage you find its second derivative. For high wages, the wage curve for Alpha lies just below Gamma's, the wage curve for Beta is just below Zeta's, and the wage curve for Delta is just below Theta's. (By "high wages", I mean wages larger than the wage for the single switch point for the given pair of techniques.) The wage curves for Epsilon and Eta are visually indistinguishable in the figure. They have a single switch point at a fairly low wage, and above that, the wage curve for Epsilon lies below Eta's. I wonder how much variations in the parameters specifying the technology result in variation in the location of wage curves.

4.0 The Capital "Market" and Aggregate Production Function

The example illustrates certain results that I find of interest. Suppose the economy produces a net output of corn. Given the wage, one can identify the cost minimizing technique. By use of the Leontief inverse for that technique, one can calculate the level of outputs in the iron, steel, and corn industries needed to replace the capital goods used up in producing a given net output of corn. In a standard notation, used in previous posts:

q = (I - A)-1 (c e3)

where I is the identity matrix, e3 is the third column of the identity matrix, c is the quantity of corn produced for the net output, A is the Leontief matrix for the cost minimizing technique at the given wage, and q is the column vector of gross outputs of iron, steel, and corn. (This relationship can be extended to a steady state, positive rate of growth, up to a maximum rate of growth.)

For the given wage, one can find prices that are consistent with the adoption of the cost minimizing technique. Let p be the three-element row vector for these prices. (Since corn is the numeraire, p3 is unity.) Consider the production of a net output of corn. The column vector of capital goods needed to produce this net output is (A q). The value of these capital goods is:

K = p A q

Let a0 be the row vector of labor coefficients for the cost minimizing technique.

L = a0 q = a0 (I - A)-1 (c e3)

Net output per worker is easily found:

y = c/L

Likewise, capital per worker is:

k = K/L

This algebra allows one to draw certain graphs for the example. Figure 3 shows the value of the capital goods the managers of firms want to employ per worker as a function of the rate of profits. As is typical in the Marshallian tradition for graphing supposedly downward-sloping demand functions, the "quantity" variable - that is, the value of the capital goods - is on the abscissa. The "price" variable - that is, the rate of profits - is graphed on the ordinate.

|

| Figure 3: Value of Capital Hired at Different Rates of Profit |

Switch points appear in Figure 3 as horizontal lines. They result from varying linear combinations of techniques, at a given price system. The curves, that are not quite vertical, between the switch points result from variations in prices and the rate of profits, for a given cost minimizing technique, with the wage along the wage-rate of profits frontier. Variation from the vertical for these curves is known as a price Wicksell effect.

While it is not obvious from the figure, the sign of the slope of the curve above the switch point between the Alpha and Beta technique changes over the range in which Alpha is the cost-minimizing technique. (This change in the direction of the price Wicksell effect is equivalent to a change in the convexity of the wage curve for the Alpha technique in the region where it lies on the outer frontier in Figure 2.) In the lower part of this uppermost locus, a lower rate of profits is associated with a greater value of capital goods per worker. This is a negative price Wicksell effect. Elsewhere, in the graph, price Wicksell effects are positive. It is not clear to me that neoclassical economists, at least after the Cambridge Capital Controversy, have any definite beliefs about the direction of price Wicksell effects.

The direction of real Wicksell effects cannot be reconciled with traditional neoclassical theory. Consider, first, the switch point between the Theta and Eta techniques. Compare the value of capital per worker at a rate of profits slightly higher than the rate of profits at the switch point with capital per worker at a rate of profits slightly lower. Notice that with this notional variation, a higher value of capital per worker is associated with a lower rate of profits. This is a negative real Wicksell effect. If capital were a factor of production, a lower equilibrium rate of profits would indicate it is less scarce, and firms would be induced to adopt a more capital-intensive technique of production. Thus, a negative real Wicksell effect illustrates traditional, mistaken neoclassical theory. But, in the example, the real Wicksell effect is positive at the switch point between the Alpha and Beta techniques.

I have above outlined how to calculated the value of output per worker and capital per worker as the wage or the rate of profits parametrically varies. Figure 1, at the head of the post, graphs the value of output per worker versus capital per worker. The scribble at the top is the production function, as in, for example, Solow's growth model.

Before considering the details of this function in the example, note that the production function is not a technological relationship, showing the quantity of a physical output that can be produced from physical inputs. Prices must be determined before it can be drawn. In particular, either the wage or the rate of profits must be given to determine a particular point on the production function. Suppose all real Wicksell effects happen to be negative, and the slope of the production function, for some index of capital intensity, happens to be equal to the rate of profits (at each switch point). Since one had to start with the wage or the rate of profits, even then one could not use the production function to determine distribution. Deriving such a marginal productivity relationship seems to be besides the point when it comes to defending neoclassical theory.

Now to details. Between switch points, a single technique lies on the frontier in Figure 2. Given the technique and net output, a certain constant output per worker results, no matter what the wage and the rate of profits in the region where that wage curve lies on the frontier. Thus, the horizontal lines in the graph of the production function reflect a region in which a switch of techniques does not occur. The downward-sloping and upward-sloping lines, in the production function, illustrate switch points. At each switch point, a linear combination of techniques minimizes costs. The perverse switch point is reflected in the production function by an upward slope at the switch point, as the rate of profits parametrically increases. I gather it is a theorem that greater capital per worker is associated with more output per worker. But in the "perverse" case, greater capital per worker is associated with a greater rate of profits.

5.0 The Labor "Market"

So much for neoclassical macroeconomics. Next, consider how much labor, firms want to hire over all three industries, to produce a given net output of corn (Figure 4). (I still follow the Marshallian tradition of putting the price variable on the Y-axis and the quantity variable on the X-axis.) Around the switch point between the Alpha and Beta technique, a slightly higher wage is associated with firms wanting to employ more labor, given net output. In the traditional neoclassical theory, a higher wage would indicate to firms that labor is scarcer, and firms would be induced to adopt less labor-intensive techniques of production. The example shows that this theory is logically invalid.

|

| Figure 4: Labor Employed at Different Wages |

6.0 Labor Employed Directly in Corn Production

Although this is not an example of reswitching, it is an example of process recurrence. (I was pleased to see that each of the six production processes is part of at least one technique with a wage curve on the frontier.) Since two processes are available for producing corn, the amount of labor that corn-producing firms want to produce, at a non-switch point, is either 1.0 or 1.5 person-years per gross output of the corn industry. These are the labor coefficients, for processes "e" and "f", in Table 1. The labor coefficients account for the locations of the vertical lines in Figure 5. Once again, a linear combination of techniques is possible at switch points. If the pair of techniques that are cost minimizing at a switch point differ in the corn-producing process, a horizontal line is shown in Table 5. The analysis of the choice of technique is needed to locate these horizontal lines.

|

| Figure 5: Labor Directly Employed in Producing Corn |

Figure 5 shows, that around the switch point for the Alpha and Beta techniques, a higher wage is associated with corn-producing firms wanting to hire more labor for direct employment in producing corn. So much for microeconomics. Those exploring the theory of production have found other results that contradict neoclassical microeconomics.

7.0 Conclusion

The above has presented an example in which, in each industry, firms have some capability to trade off inputs, in some sense. For producing a unit output of iron or steel, they might be able to lower labor inputs at the expense of needing to hire more commodities used directly in producing that output. As I understand it, if possibilities of substitution are increased without end, traditional mistaken parables, preached by mainstream economists, are not restored. Suppose the cost-minimizing technique varied continuously along the wage-rate of profits frontier. A specific coefficient of production, as a process varied in some industry, would not necessarily vary continuously. The stories of marginal adjustments that many mainstream economists have been telling for over a century seem to be contradicted by the theory of production.

I have highlighted three results, at least, for the example:

- Around a so-called perverse switch point, a lower rate of profits is associated with firms wanting to adopt a technique in which the value of capital goods, per worker, is less than at a higher rate of profits.

- In the labor market for the economy as a whole, a higher wage can be associated with firms wanting to employ more workers to produce a given (net) output.

- In a given industry, a higher wage can be associated with firms in that industry wanting to employ more workers to produce a given (gross) output.

The last result, at least, is independent of the first. For instance, examples exist of non-perverse switch points in which this result arises.

The theory of supply and demand has been lying in tatters, destroyed for about half a century. Many economists seem to be ignorant of this, though.