In the

first part, I describe the technology a firm faces. This technology consists of two production processes for producing iron and one process for producing corn. A technique of production is defined in this example to consist of exactly one iron-producing process and the corn-producing process. In the

second part, I describe the levels of operations of the processes comprising each technique such that net output consists of one Bushel corn.

Consider the managers of a competitive firm. They know this technology and decide on the level of operation of each production process. In this model, the prices the firm faces are taken as parametric by the firm. The firm is assumed to begin the year owning an inventory of iron and corn. This inventory, if it is not in the correct proportion to serve as inputs in the production processes that managers decide upon, can be traded on the market. The value of the inventory, however, imposes a constraint. The value of the inputs to the production processes cannot exceed the value of the inventory. (Since labor is assumed to be paid out of the product at the end of the year, labor does not enter into this constraint.) The firm decides on the level of operation of each process to maximize the increment of value.

I take a Bushel corn as the numeraire. So the price of iron is expressed in units of Bushels per Ton, and the wage is expressed in units of Bushels per Person-Year. Some notation is useful to set out the firm’s decision problem. Let:

- X1 be the gross amount of iron produced with the first iron-producing process.

- X2 be the gross amount of iron produced with the second iron-producing process.

- X3 be the gross amount of corn produced (with the corn-producing process).

- p be the price of iron (in units of Bushels per Ton).

- w be the wage (in units of Bushels per Person-Year). The wage is paid at the end of the year to workers employed during the year.

- r be the rate of (accounting) profits.

- ω1 be the Tons iron in the firm's inventory at the start of the year.

- ω2 be the Bushels corn in the firm's inventory at the start of the year (after having sold net output to consumers at the end of the last year).

Using this notation, the firm’s problem is easily expressed:

Choose X1, X2, and X3

To Maximize [p - (1/10) p - (1/40) - w] X1+ [p - (229/494) p - (3/1,976) - (305/494) w] X2+ [1 - 2 p - (2/5) - w] X3

Such That[(1/10) p + (1/40)] X1+ [(229/494) p + (3/1,976)] X2+ [2 p + (2/5)] X3does not exceed (p ω1 + ω2)

And X1, X2, and X3 are all nonnegative

The above Linear Program has a dual:

Choose r

To Minimize (p ω1 + ω2) r

Such That

[(1/10) p + (1/40)](1 + r) + w is not less than p

[(229/494) p + (3/1,976)](1 + r) + (305/494) w is not less than p

[2 p + (2/5)](1 + r) + w is not less than 1

And r is nonnegative

Dual Linear Programs have some elegant mathematical properties. If a decision variable is positive in the optimal solution to the primal Linear Program, the corresponding constraint is met with equality in the dual. For example, suppose profit-maximizing firms would like to operate the first iron-producing process (

X1 > 0). Then the cost of operating this process, including the imputed profits earned on the financial capital advanced to pay for the inputs, just covers the revenue obtained from producing the iron. In other words, the first constraint in the dual Linear Program is met with equality.

The above analysis shows which processes, if any, firms will be willing to operate at any given wage and price of iron. But firms will be willing to operate both the corn-producing process and at least one iron-producing process only at specific configurations of these prices. Yet this industry is sustainable only if firms are willing to operate such a combination of processes. Accordingly, I analyze only combinations of prices in which firms in this vertically-integrated industry can continue to operate.

For example, suppose firms are willing to operate the first technique (

X1 > 0 and

X3 > 0). Then the costs, including imputed profits, of producing a Ton of iron (with the first process) and a Bushel of corn must be equal to the price of iron (

p) and the price of corn (unity), respectively. These conditions determine a system of two equations with three unknowns (

w,

r, and

p). Suppose the wage is externally specified, perhaps on a competitive labor "market". Then, if firms are to be willing to adopt this technique, the price of iron and rate of profits must be as specified by this system of equations. A corresponding system of equations arises for the second technique from the dual Linear Program.

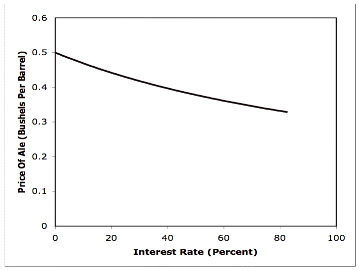

Table 3-1 shows some solutions of the price equations that arise from this logic. The selected solutions are shown for increasing wages or decreasing rates of profits. (When I write about "increasing" or "decreasing", I am now only making claims abouts the shapes of certain mathematical functions. See Samuelson (1975)). The rate of profits is lower for higher wages. At a certain upper limit on wages, the rate of profits is zero. At wages higher than this, no price of iron exists at which firms will be willing to produce both iron and corn, and the data would be inconsistent with an economy continuing to be reproduced. But consider the wages shown in the table. At a wage of 459/64,100 Bushels per Person-Year, the second technique is cost-minimizing. The cost of producing iron with the first iron-producing process exceeds the price of iron by 245/48,716 Bushels per Ton. On the other hand, the first technique is cost minimizing at wage of 13/220 Bushels per Person-Year. At this wage, the cost of producing iron by the second iron-producing process exceeds the price of iron by 45/10,868 Bushels per Ton. At the wage of 13/850 Bushels per Person-Year, both techniques are cost-minimizing. A wage, or rate of profits, like this, at which more than one technique is cost-minimizing is defined to be a

switch point. It is left as an exercise for the reader to find rates of profits and prices of iron in general. (Hint: the other switch point in the example is at

r = 20%.)

Table 3-1: Some Price DataWAGE

(BUSHELS PER

PERSON-YEAR) | RATE OF

PROFITS

(PERCENT) | PRICE

OF IRON

(BUSHELS PER TON) | POSITIVE PRIMAL

DECISION

VARIABLES |

|---|

| 459/64,100 | 90% | 2,985/48,716 | X2, X3 |

| 13/850 | 80 | 5/68 | X1, X2, X3 |

| 13/220 | 50 | 5/44 | X1, X3 |

Since both techniques are cost-minimizing at the switch point at

w = 13/850 Bushels per Person-Year, the value of capital per worker can be at different levels with unchanged prices. At these prices, capital per worker can take on any level between the two values shown in the last column of Table 3-2. This variation of capital intensity at a switch point, in which the physical composition of capital goods varies but prices are unchanged, is known as a

real Wicksell effect. Neoclassical economists used to think of prices as scarcity indices (e.g., Hayek 1945). Suppose the rate of profits were a scarcity index for capital. Then a willingness of consumers to supply more capital (i.e., increase savings) would result in a lower rate of profits. One would expect that the technique preferred at a rate of profits slightly lower than the switch point rate of profits would be more capital-intensive than the technique preferred at a slightly higher rate of profits. This expected negative association between the rate of profits and the change in the value of capital due to changes in the physical composition of capital goods is known as a

negative real Wicksell effect.

"...a negative real Wicksell effect is the appropriate concept of 'capital deepening' in a model with many heterogeneous capital goods." (Burmeister 1987)

Table 3-2: Capital-Theoretic Properties Of Switch Point At r = 80%| TECHNIQUE | CAPITAL GOODS

PER BUSHEL

NET OUTPUT | VALUE OF

CAPITAL PER

BUSHEL | VALUE OF

CAPITAL PER

PERSON-YEAR |

|---|

| X1, X3 | 200/49 Tons,

41/49 Bushels | 947/833 Bushels | 947/4,930 Bushels |

| X2, X3 | 1,976/315 Tons,

43/63 Bushels | 175/153 Bushels | 35/170 Bushels |

The example shows that the concept of capital deepening as a supposedly logical implication of profit maximizing is no such thing. The technique in the last row in Table 3-2 is more capital-intensive. Yet, as illustrated in Table 3-1, this technique is also preferred at rates of profit somewhat higher than the switch point being examined here, while the technique in the first row is preferred at interest rates slightly lower. This phenomena of a positive association between capital intensity and the rate of profits, where the variation in capital intensity is due to a variation in the composition of capital goods at a given switch-point rate of profits, is known as a

positive real Wicksell effect,

reverse capital deepening, or

capital reversing. Its possibility, as proven by this example, shows that the vision underlying the Neoclassical theory of value and distribution is logically invalid.

These capital theory findings have implications for labor economics. Here’s one opinion:

“...it is now clear that there is no general way to classify technological processes as simply more or less labor-intensive, at least not if one means by that form of words that more labor-intensive technologies always correspond (in a given state of technological knowledge) to a lower real wage and therefore a higher interest rate along the factor-price frontier in steady-state equilibrium. More generally, and more important, it is not true, even with all the standard assumptions, that steady states with lower interest rates have higher consumption per worker. That is interesting.”

(Solow 1975)

I would put it somewhat differently. Table 3-3 gives some more information about the switch point at which capital reversing occurs. The stationary state consumption per worker is shown in the second column. The technique in the lower row has higher consumption per worker. Since around this switch point, the technique in the upper row is cost-minimizing at lower rates of profits, this example illustrates the point that Solow says is “more important”. The last column in Table 3-3 gives a measure of the labor intensity of these two techniques. The technique in the first row is more labor intensive. Around this switch point, the more labor-intensive technique is adopted at higher wages, while the less labor-intensive technique is adopted at lower wages. Since the rate of profits is not a scarcity index for capital, wages are not a scarcity index for labor. Firms wanting to hire more labor at a higher wage, given technological knowledge and the level of net output, is consistent with the theory of competitive profit-maximizing.

Table 3-3: Labor-Theoretic Properties Of Switch Point At w = 13/850| TECHNIQUE | PRODUCTIVITY

(OUTPUT PER

PERSON-YEAR) | PERSON-YEAR

PER

BUSHEL |

|---|

| X1, X3 | 49/290 Bushels | 290/49 Person-Years |

| X2, X3 | 9/50 Bushels | 50/9 Person-Years |

References- Burmeister, Edwin (1987). "Wicksell Effects", New Palgrave: A Dictionary of Economics (Edited by John Eatwell, Murray Milgate, and Peter Newman), Macmillan.

- Hayek, F. A. (1945). "The Use of Knowledge in Society", American Economic Review, V. 35, N. 4 (Sep.): 519-530.

- Samuelson, Paul A. (1975). "Steady-State and Transient Relations: A Reply on Reswitching", Quarterly Journal of Economics, V. 89, N. 1 (Feb.): 40-47.

- Solow, Robert M. (1975). “Reswitching: Brief Comments”, Quarterly Journal of Economics, V. 89, N. 1 (Feb.): 48-52.